It’s a heart-stopping moment when you realise a cherished piece of jewellery is missing. That sudden feeling of knowing your diamond ring isn’t where it should be is overwhelming loss, panic and worry are rolled into one horrible, heart-wrenching, moment.

It’s an emotional experience that can leave you feeling deeply upset.

Diamond rings and other precious jewellery often carry memories that go beyond their monetary value. Engagement rings, wedding bands, and heirlooms are cherished for the stories they represent. So, it is understandable why losing one can feel like losing a part of your personal history.

But it isn’t just the emotional impact of losing a diamond ring that can affect you there is the financial impact too.

The financial impact of losing a diamond ring

The actual replacement or repair of a diamond ring can be stressful especially financially due to cost factors:

- The value of diamonds and precious metals can increase over time. Without insurance, replacing your ring at current market prices could be much more expensive than when you first bought it.

- Repairing or replacing custom/bespoke ring designs, rare gemstones, vintage rings and rings bought at auction, as well as those with intricate craftsmanship, can all be costly.

This is where diamond ring insurance steps in. While it can't replace the sentimental value of your jewellery, it can provide a significant emotional relief by helping with the financial cost if something unexpected happens. Whether your ring is lost, stolen, or accidentally damaged, you can have it repaired or replaced quickly and stress-free, giving you peace of mind and allowing you to focus on the memories your ring holds.

Everyday risks: Why protection matters

It’s surprisingly easy to lose or damage a ring, whether it slips off while you are washing your hands, applying hand lotion, or during everyday activities. Rings can also be dropped, forgotten in public places, or even stolen.

No matter how careful you are, accidents can happen when you least expect them.

Jewellery insurance acts as a safety net, ensuring that a simple mistake or unexpected event doesn't become costly.

Diamond ring insurance: What’s covered?

Many jewellery insurance policies cover accidental loss, theft, and damage, whether at home or abroad. It is important, however, that you check the policy features and benefits before you buy, as cover can vary depending on the provider.

It is also essential you understand what the policy exclusions are – these are things that cannot be claimed for. Understanding these exclusions can give you a sense of security, knowing exactly what situations your insurance will and won't cover.

What exclusions may ring insurance have?

This will depend on your policy provider, but most jewellery insurance policies generally won’t cover damage from everyday wear and tear, gradual deterioration, or negligence. For example, if you leave your ring unattended in a public place and it goes missing, the loss might not be covered.

Understand what you need to do to comply with your policy’s terms

Under the terms of your jewellery insurance policy, you will typically need to comply with specific conditions - such as storing your jewellery in a safe when it is not being worn.

Check the cover limits (also known as the “sum insured”)

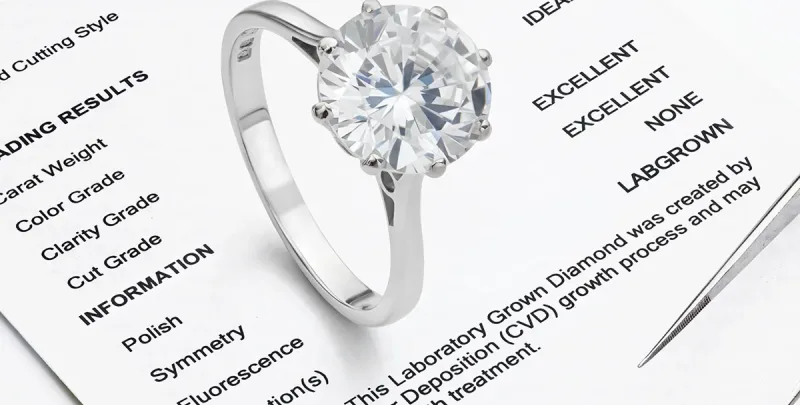

Some policies have limits based on your ring’s appraised value, so it’s important to have your ring professionally appraised and keep detailed records, including photos and receipts. This helps ensure your policy reflects the true value of your diamond ring or other jewellery, so you’ll be fully covered if the unexpected happens.

Getting the most suitable jewellery insurance

Knowing you have the most appropriate cover for your jewellery gives you peace of mind. If you have any questions about diamond ring insurance from Assetsure, please call us on 0208 0033 190. We're here to provide the support and guidance you need, ensuring you feel confident and secure in your insurance choice.

In the meantime, here are a few tips on keeping your ring safe …

How to prevent losing your diamond ring

It’s easy to misplace a ring, but these simple habits can help prevent loss:

- Use small ring dishes: Keep little ring dishes in key spots around your home - like the bathroom, kitchen, and bedside table - so you’ve always got a safe place to pop your ring when you need to take it off.

- Double-check before leaving places: Before you leave a public restroom, gym, or hotel room, do a quick check to make sure you’ve got your ring.

- Travel smart: If you’re travelling, think about leaving your ring at home if you don’t really need it. But if you do bring it, make sure to store it securely when you’re not wearing it - just check with your insurer first to see if it needs to be kept in a specific place, like a room safe.

What to do if you lose your diamond ring

If your ring goes missing, acting quickly can boost your chances of finding it:

- Retrace your steps: Go back over where you’ve been and check thoroughly - don’t forget places like sinks and drains where the ring could have fallen. Or even the inside of gloves!

- Alert local businesses: If you lost your ring in a public place, inform nearby businesses so they can keep an eye out.

- Check lost and found services: Contact the lost and found departments of public transport services, event venues, and hotels.

- Use social media: Post about your lost ring in local community groups and social media platforms - it’s a great way to get more eyes looking for it.

- Notify your insurer: If you’ve got jewellery insurance, report the loss as soon as possible to start the claims process.

Peace of mind for every moment

Wearing a diamond ring should be about joy, not stress. Whether you're travelling, attending events, or just going about your day, knowing your ring is protected means you can wear it confidently - without worrying about what might happen.